Home Equity Loan Guide: Exactly How to Use and Qualify

Home Equity Loan Guide: Exactly How to Use and Qualify

Blog Article

Leverage Your Home's Value: The Advantages of an Equity Finance

When taking into consideration financial choices, leveraging your home's worth through an equity finance can supply a tactical approach to accessing extra funds. The benefits of touching into your home's equity can extend beyond plain comfort, supplying a variety of benefits that satisfy various financial requirements. From versatility in fund usage to possible tax benefits, equity lendings offer a chance worth checking out for property owners seeking to optimize their monetary sources. Understanding the subtleties of equity financings and how they can favorably impact your monetary profile is vital in making informed choices for your future financial wellness.

Advantages of Equity Loans

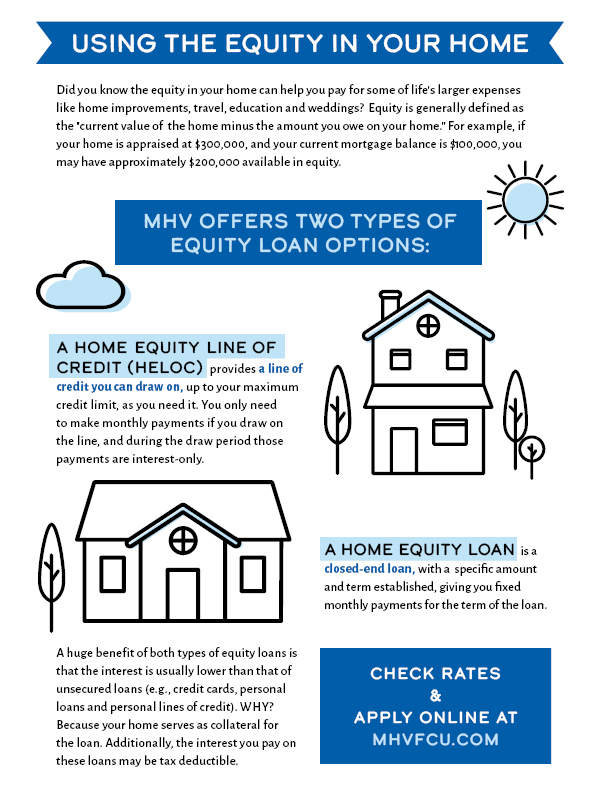

One of the main benefits of an equity financing is the capability to access a big amount of money based on the value of your home. This can be particularly advantageous for property owners that need a substantial amount of funds for a certain purpose, such as home enhancements, debt loan consolidation, or major expenditures like clinical bills or education and learning prices. Unlike various other kinds of lendings, an equity funding usually offers reduced rate of interest because of the collateral supplied by the property, making it an economical loaning alternative for many individuals.

Additionally, equity car loans often offer extra adaptability in terms of settlement routines and finance terms contrasted to various other kinds of funding. Generally, the ability to gain access to substantial sums of cash at lower passion prices with versatile payment options makes equity finances a useful financial device for home owners looking for to utilize their home's value.

Versatility in Fund Usage

Provided the helpful borrowing terms related to equity car loans, home owners can efficiently utilize the versatility in fund usage to satisfy various financial needs and goals. Equity lendings offer house owners with the liberty to make use of the obtained funds for a wide variety of functions. Whether it's home remodellings, debt loan consolidation, education and learning expenses, or unanticipated clinical expenses, the adaptability of equity financings enables individuals to address their economic requirements efficiently.

One trick benefit of equity fundings is the lack of restrictions on fund usage. Unlike a few other kinds of car loans that define just how the borrowed money needs to be spent, equity fundings offer debtors the freedom to assign the funds as needed. This versatility makes it possible for property owners to adjust the lending to match their unique situations and top priorities. Whether it's investing in a new service venture, covering emergency expenses, or funding a major acquisition, equity fundings equip home owners to make calculated economic choices lined up with their objectives.

Prospective Tax Benefits

One of the key tax advantages of an equity lending is the capability to subtract the interest paid on the finance in specific circumstances. In the United States, for instance, interest on home equity car loans up to $100,000 may be tax-deductible if the funds are utilized to improve the home securing the loan.

In addition, using an equity funding to settle high-interest financial debt may also bring about tax benefits. By paying off bank card financial obligation or other financings with greater rates of interest utilizing an equity lending, homeowners may have the ability to deduct the passion on the equity loan, potentially conserving also more cash on taxes. It's essential for house owners to seek advice from a tax advisor to understand the details tax obligation effects of an equity funding based upon their individual situations.

Lower Rates Of Interest

When discovering the monetary benefits of equity fundings, one more essential element to think about is the potential for house owners to safeguard lower passion prices - Equity Loans. Equity loans often offer reduced rate of interest prices compared to various other types of borrowing, such as individual loans or charge card. This is because equity loans are secured by the worth of your home, making them much less risky for lending institutions

Reduced passion rates can cause substantial cost savings over the life of the car loan. Also a little percent difference in interest rates can translate to considerable cost savings in passion repayments. Property owners can use these savings to pay off the lending quicker, construct equity in their homes much more rapidly, or buy other locations of their monetary profile.

In addition, lower rate of interest can improve the overall affordability of loaning against home equity - Alpine Credits Home Equity Loans. With lowered rate of interest costs, home owners may discover it much easier to handle their regular monthly settlements and preserve economic stability. By capitalizing on lower rate of interest through an equity lending, homeowners can utilize their home's worth better to meet their economic objectives

Faster Access to Funds

House owners can speed up the procedure of accessing funds by utilizing an equity financing protected by the worth of their home. Unlike other funding alternatives that may include extensive approval treatments, equity fundings offer a quicker route to getting funds. The equity constructed up in a home acts as collateral, providing loan providers better self-confidence in extending credit score, which streamlines the approval process.

With equity car loans, property owners can access funds quickly, often getting the cash in a matter of weeks. This fast accessibility to funds can be essential in situations requiring immediate economic assistance, such as home renovations, clinical emergency situations, or debt combination. Alpine Credits. By using their home's equity, homeowners can swiftly attend to pushing monetary requirements without prolonged waiting periods typically linked with other sorts of loans

Furthermore, the structured process of equity car loans equates to quicker dispensation of funds, making it possible for house owners to take timely financial investment chances or manage unpredicted costs successfully. Overall, the expedited accessibility to funds through equity car loans highlights their practicality and convenience for house owners looking for punctual financial remedies.

Conclusion

Unlike some other types of car loans that specify how the obtained money needs to be invested, equity loans provide debtors the freedom to allocate the funds as required. One of the primary tax advantages of an equity finance is the capability to subtract the interest paid on the funding in specific situations. In the United States, for example, interest on home equity fundings up to $100,000 might be tax-deductible if the funds are utilized to improve the building safeguarding the lending (Equity Loan). By paying off credit history card debt or other financings with greater passion rates using an equity funding, homeowners might be able to deduct the interest on the equity car loan, possibly conserving even more cash on tax obligations. Unlike various other funding choices that might entail extensive approval procedures, equity loans supply a quicker route to acquiring funds

Report this page